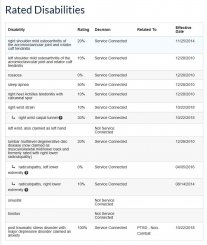

Hello everyone. I was medically retired from the Army in 2010 with 40% permanent disability as an E-5 but with E-4 pay because of the high 36. I was National Guard total 12 years of service with 3 good active duty years. I was 80% from VA than raised to 90% and recently increased to 100% PTSD permanent and total along with ratings for other conditions. I just found out that I could qualify for CRSC through an old Army buddy of mine because of me having to waive the retired Army pay in order to receive VA disability. I was also told that I can qualify for retro but only 6 years back not sure if it's true or not but I went and submitted the CRSC paper work. Can someone help me out with this crazy math please. VA pays me as married 2 children. Any help will be greatly appreciated.

- Forums

- PEB and Disability Evaluation System Overview

- Physical Evaluation Board System Overview

- Outcomes: Fit, Severance, TDRL, PDRL

- Combat Related Special Compensation (CRSC)

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

CRSC Help

- Thread starter barretoa069

- Start date

All of the following is needed for an estimate:Hello everyone. I was medically retired from the Army in 2010 with 40% permanent disability as an E-5 but with E-4 pay because of the high 36. I was National Guard total 12 years of service with 3 good active duty years. I was 80% from VA than raised to 90% and recently increased to 100% PTSD permanent and total along with ratings for other conditions. I just found out that I could qualify for CRSC through an old Army buddy of mine because of me having to waive the retired Army pay in order to receive VA disability. I was also told that I can qualify for retro but only 6 years back not sure if it's true or not but I went and submitted the CRSC paper work. Can someone help me out with this crazy math please. VA pays me as married 2 children. Any help will be greatly appreciated.

- High three average base pay OR gross retired pay on DFAS RAS (indicate which is provided) Example: 3500 from DFAS RAS (Info from most recent DFAS RAS is preferred since it includes recent COLA increases)

- Precise number of active duty or active duty equivalent years and months. Example: 9 years and 3 months active duty

- DoD Disability percentage Example: 60% DoD

- VA percentage; the amount; and number of dependents by category Example: 100%; 3400; spouse and 3 children under 18

- Approved CRSC rate OR expected CRSC rate Example: 80% approved CRSC

- Indicate if any of the following apply: have 20 good years for reserve retirement OR received REDUX Example: have 20 good years for reserve retirement.

Note: Your CRSC will likely be: active duty equivalent (years & months) x 2.5% = multiplier

Multipler x high three average = dollar amount of longevity portion of retirement pay & potential CRSC in your case.

Ron

I am new to this and not very familiar with the math.All of the following is needed for an estimate:

Active duty equivalent for reservists: Retirement orders should have this info.

- High three average base pay OR gross retired pay on DFAS RAS (indicate which is provided) Example: 3500 from DFAS RAS

- Precise number of active duty or active duty equivalent years and months. Example: 9 years and 3 months active duty

- DoD Disability percentage Example: 60% DoD

- VA percentage; the amount; and number of dependents by category Example: 100%; 3400; spouse and 3 children under 18

- Approved CRSC rate OR expected CRSC rate Example: 80% approved CRSC

- Indicate if any of the following apply: have 20 good years for reserve retirement OR received REDUX Example: have 20 good years for reserve retirement.

Note: Your CRSC will likely be: active duty equivalent (years & months) x 2.5% = multiplier

Multipler x high three average = dollar amount of longevity portion of retirement pay & potential CRSC in your case.

Ron

Dependents are Spouse and 2 children under 18

high 36 with 40% DOD= 2293.80 monthly

Current VA 100% not taking in consideration SMC= 3,437

Good active duty years=3 "Total 12 years service Guard/reserves and active duty. Only want to consider 3 good years as I want to be conservative on estimates. After all my commander used to tell us Expect The Worst and Hope For The Best".

Just submitted my CRSC application a few weeks ago to see if It does get approved not too sure since I have heard is a hit or miss.

Hello,

Is 2293.80 the gross on your RAS @ 40%? It is not clear in the manner you posted it. If 2293.80 is the gross, it is not high three but I can use it to determine high three. The preferred format was provided.

Ron

Is 2293.80 the gross on your RAS @ 40%? It is not clear in the manner you posted it. If 2293.80 is the gross, it is not high three but I can use it to determine high three. The preferred format was provided.

Ron

Estimate using info available:

2293.80 gross/0.40 = 5735 high three

3 yrs AD x 0.025 = 7.5%

5735 x 0.075 = about 430.13 dollar amount of longevity portion of retirement pay

CRSC = about $430...however I doubt E4 Pay is 5735 per month.

IF, high three is 2293.80, then...

2293.80 x 0.075 = 172.04 dollar amount of longevity portion of retirement pay and monthly CRSC in this case.

Ron

2293.80 gross/0.40 = 5735 high three

3 yrs AD x 0.025 = 7.5%

5735 x 0.075 = about 430.13 dollar amount of longevity portion of retirement pay

CRSC = about $430...however I doubt E4 Pay is 5735 per month.

IF, high three is 2293.80, then...

2293.80 x 0.075 = 172.04 dollar amount of longevity portion of retirement pay and monthly CRSC in this case.

Ron

Hello,

Is 2293.80 the gross on your RAS @ 40%? It is not clear in the manner you posted it. If 2293.80 is the gross, it is not high three but I can use it to determine high three. The preferred format was provided.

Ron

[/QUOTE

2293.00 would be the full amount of retirement I would be if I was 100% DOD since I am 40% DOD the amount would be 917.52 "RAS" which was back in 2010 I have not looked at one ever since I waived the retirement for VA pay in 2010

. This is based on the high 36 from 2010.

Thanks a lot for your help.

Hello,

Using your figures and explantation:

IF, high three is 2293.80, then...

2293.80 x 0.075 = 172.04 dollar amount of longevity portion of retirement pay and monthly CRSC in this case.

If your amount came from 2010 data, there are several COLA increases since then.

Ron

Using your figures and explantation:

IF, high three is 2293.80, then...

2293.80 x 0.075 = 172.04 dollar amount of longevity portion of retirement pay and monthly CRSC in this case.

If your amount came from 2010 data, there are several COLA increases since then.

Ron

So that means I would get an extra 172.04 on top of the 100% VA pay that I currently get. I thought that I would either get the same amount I had to waive which was the 917.52 a month or at least half of that. So the question now becomes is CRSP and concurrent pay the same thing or would it be separate applications. Either way what ever happens happens.Estimate using info available:

2293.80 gross/0.40 = 5735 high three

3 yrs AD x 0.025 = 7.5%

5735 x 0.075 = about 430.13 dollar amount of longevity portion of retirement pay

CRSC = about $430...however I doubt E4 Pay is 5735 per month.

IF, high three is 2293.80, then...

2293.80 x 0.075 = 172.04 dollar amount of longevity portion of retirement pay and monthly CRSC in this case.

Ron

Hi,

Yes, you receive the “172” in addition to VA compensation.

1. You are not eligible for CRDP, which generally requires 20 years AD. The exceptions do not apply to you.

2. The 172 amount is from data 8-9 years ago...you provided. COLAs increase that amount.

3. CRSC can never be more than the dollar amount of the longevity portion of retirement pay...172 using your data.

4. Recommend reading Computation of CRSC <—- LINK

Also:

DFAS CRSC LINK <—-

DFAS CRDP LINK <—-

Ron

Yes, you receive the “172” in addition to VA compensation.

1. You are not eligible for CRDP, which generally requires 20 years AD. The exceptions do not apply to you.

2. The 172 amount is from data 8-9 years ago...you provided. COLAs increase that amount.

3. CRSC can never be more than the dollar amount of the longevity portion of retirement pay...172 using your data.

4. Recommend reading Computation of CRSC <—- LINK

Also:

DFAS CRSC LINK <—-

DFAS CRDP LINK <—-

Ron

(Selected) History of Concurrent Receipt

Concurrent receipt refers to the simultaneous receipt of two types of federal monetary benefits:

military retired pay and Department of Veterans Affairs (VA) disability compensation. Prior to

2004, existing laws and regulations dictated that a military retiree could not receive two

payments from federal agencies for the same purpose. As a result, military retirees with physical

disabilities recognized by the VA would have their military retired pay offset or reduced dollar-

for-dollar by the amount of their non-taxable VA compensation.

Legislative activity on the issueof concurrent receipt began in the late 1980s and culminated in the provision for Combat-Related Special Compensation (CRSC) in the Bob Stump National Defense Authorization Act for Fiscal Year 2003 (P.L. 107-314). Since then, Congress has added Concurrent Retirement and Disability Payments (CRDP) for those retirees with a disability rated at 50% or greater, extended concurrent receipt to additional eligible populations, and further refined and clarified the program.

There are two common criteria that define eligibility for concurrent receipt: (1) all recipients must be military retirees and (2) they must also be eligible for VA disability compensation. An eligible retiree cannot receive both CRDP and CRSC. The retiree must choose whichever is most financially advantageous to him or her and may change the type of benefit to be received during an annual open season.

Amounts paid under the programs are established by law.

Ron

Concurrent receipt refers to the simultaneous receipt of two types of federal monetary benefits:

military retired pay and Department of Veterans Affairs (VA) disability compensation. Prior to

2004, existing laws and regulations dictated that a military retiree could not receive two

payments from federal agencies for the same purpose. As a result, military retirees with physical

disabilities recognized by the VA would have their military retired pay offset or reduced dollar-

for-dollar by the amount of their non-taxable VA compensation.

Legislative activity on the issueof concurrent receipt began in the late 1980s and culminated in the provision for Combat-Related Special Compensation (CRSC) in the Bob Stump National Defense Authorization Act for Fiscal Year 2003 (P.L. 107-314). Since then, Congress has added Concurrent Retirement and Disability Payments (CRDP) for those retirees with a disability rated at 50% or greater, extended concurrent receipt to additional eligible populations, and further refined and clarified the program.

There are two common criteria that define eligibility for concurrent receipt: (1) all recipients must be military retirees and (2) they must also be eligible for VA disability compensation. An eligible retiree cannot receive both CRDP and CRSC. The retiree must choose whichever is most financially advantageous to him or her and may change the type of benefit to be received during an annual open season.

Amounts paid under the programs are established by law.

Ron

barretoa069,

CRSC replaces some or all waived retired pay.

Some of the limitations:

—CRSC cannot exceed the amount of the VA offset (waiver)

—CRSC cannot exceed the dollar amount of the longevity portion of retirement pay

—CRSC cannot replace the waived retirement pay in excess pay of longevity (i.e, that portion that is disability)

Your case:

high three is 2293.80, then...

2293.80 x 0.075 = 172.04 dollar amount of longevity portion of retirement pay and monthly CRSC in this case.

1. 2293.80 (old rate) x 40% DoD retirement rate = 917.42 retired pay

2. Longevity portion of retirement pay = 172.04

3. 917.42 minus 172.04 = 745.38 which cannot be replaced by CRSC since it is in excess of longevity portion of retirement pay

Ron

CRSC replaces some or all waived retired pay.

Some of the limitations:

—CRSC cannot exceed the amount of the VA offset (waiver)

—CRSC cannot exceed the dollar amount of the longevity portion of retirement pay

—CRSC cannot replace the waived retirement pay in excess pay of longevity (i.e, that portion that is disability)

Your case:

high three is 2293.80, then...

2293.80 x 0.075 = 172.04 dollar amount of longevity portion of retirement pay and monthly CRSC in this case.

1. 2293.80 (old rate) x 40% DoD retirement rate = 917.42 retired pay

2. Longevity portion of retirement pay = 172.04

3. 917.42 minus 172.04 = 745.38 which cannot be replaced by CRSC since it is in excess of longevity portion of retirement pay

Ron