Hello All,

Has anyone recently used the DFAS Disability Estimator for CSRC? I finally received my CSRC response after 11+ months and was awarded 90% combat related. I'm having issues coming u with a possible ballpark.

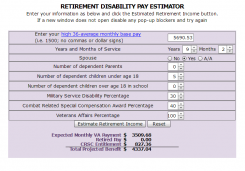

The DFAS Estimator is somewhat outdated, but at least I was hoping to get a general idea:

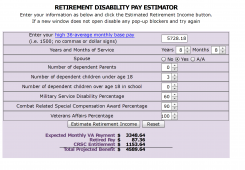

VS my calculation of :

--5728.18 H-3

--8 yrs, 8 mo = 8.67 yrs

--8.67 x 2.5% = 21.675%

--5728.18 x 21.675 = 1241.58 longevity portion of retirement

--5728.18 x 60% = 3,436.00 ret pay--all waived via VA offset

--100% VA w/spouse & 3 c = 3,531.47

--CRSC approved 90% = 2189.68 (this is less than 1500.79 longevity portion of ret pay)

--CRSC Offset 3,436.00 - 1241.58 = 2194.42

--CRSC 2189.68 - 2194.42 = 0

--CRSC= 0

Which is the most accurate?

Thanks!

Has anyone recently used the DFAS Disability Estimator for CSRC? I finally received my CSRC response after 11+ months and was awarded 90% combat related. I'm having issues coming u with a possible ballpark.

The DFAS Estimator is somewhat outdated, but at least I was hoping to get a general idea:

VS my calculation of :

--5728.18 H-3

--8 yrs, 8 mo = 8.67 yrs

--8.67 x 2.5% = 21.675%

--5728.18 x 21.675 = 1241.58 longevity portion of retirement

--5728.18 x 60% = 3,436.00 ret pay--all waived via VA offset

--100% VA w/spouse & 3 c = 3,531.47

--CRSC approved 90% = 2189.68 (this is less than 1500.79 longevity portion of ret pay)

--CRSC Offset 3,436.00 - 1241.58 = 2194.42

--CRSC 2189.68 - 2194.42 = 0

--CRSC= 0

Which is the most accurate?

Thanks!