Bprin10,

I am sorry to hear that you are having issues with the benefits you you have earned. I actually just officially retired (26 Dec) and have yet to receive compensation from either the VA or DFAS. As for your questions regarding my DD214:

25. AFI 36-3212 (AR 635-40 equivalent reg for USAF)

26. SEK or Temporary Disability (Enhanced)

28. Disability, Temporary IDES

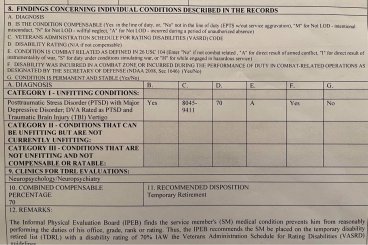

Seeing your narrative leads me to believe that block 28 for me should also state Combat Related to match my PEB findings listed on AF 356 (DA 199 equivalent) and retirement orders. ** SEE BELOW**

(AF form 356)

View attachment 7330

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

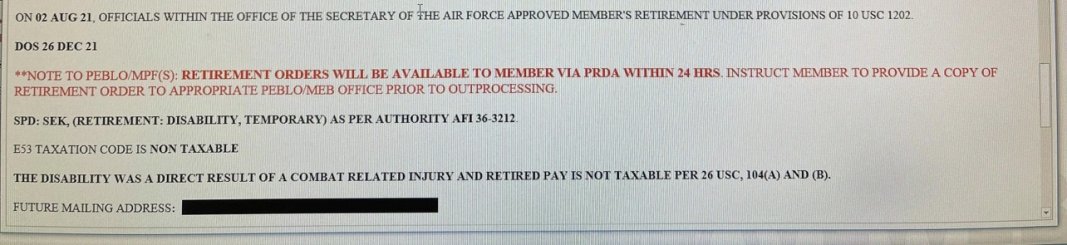

(Excerpt from Retirement Orders)

View attachment 7332

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Either way, I should know the verdict as DFAS should be updated to reflect my retirement compensation around 20 January followed by eBenefits on the VA side within the next 60 days. I highly suspect that federal taxes WILL be deducted for me as well.

I believe the "Combat Related" designation in the narrative is also crucial in determining a veteran's eligibility to "buy back" military service time for credit within the FERS (Federal Employees Retirement System). For those who choose to continue Federal service after their military careers were cut short due to combat related disabilities, this is arguably one of the most important benefits as it directly impacts retirement age and pension amount.

Please feel free to PM me as I do not want to loose track of this. Like you mentioned, we are probably not the first nor will we be the last to encounter these issues. At the very least we can publish our outcomes to educate future veterans who will inevitably navigate the same confusing process. At most, we may just uncover mass inconsistencies in how Combat Related Injury PEB findings are translated to the DD214, potentially negatively impacting the veteran's federal tax obligation.