Hello, I recently received my retirement order after my PEB. I'm going to be out of town for a few months with no ability to submit retirement documentation so I'm trying to get everything together to submit to Army before I leave, which is before my retirement date.

Army Retirement Order Questions:

1. What is the Allotment Code on the order? The statement is: "Retirement Type and allotment code: Permanent/11"

a. I can't find anything online about that allotment code

2. As far as time in service is concerned, what is meant by Disability Retirement: 14 yrs 2 mos 10 days vs Basic Pay: 22 yrs 5 mos 29 days?

a. Are either of these used in determining longevity? Because points wise, 3606 I only have 10 years of AD service.

Other Questions:

3. With regard to applying for CRSC pay, do they use the 10 years or the 14 years listed above?

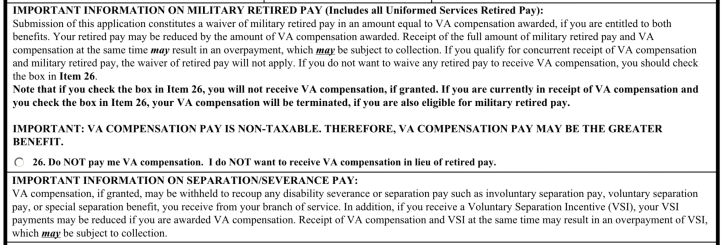

4. How do you apply for the VA waiver? Is it automatic when you fill out the DD 2656 and select, "Yes I'm receiving VA PAY?"

My State (National Guard) retirement office will only speak to me after I retire. I will not have that opportunity until after 120 days after I retire. I need to figure this stuff out now so I can submit paperwork early.

Army Retirement Order Questions:

1. What is the Allotment Code on the order? The statement is: "Retirement Type and allotment code: Permanent/11"

a. I can't find anything online about that allotment code

2. As far as time in service is concerned, what is meant by Disability Retirement: 14 yrs 2 mos 10 days vs Basic Pay: 22 yrs 5 mos 29 days?

a. Are either of these used in determining longevity? Because points wise, 3606 I only have 10 years of AD service.

Other Questions:

3. With regard to applying for CRSC pay, do they use the 10 years or the 14 years listed above?

4. How do you apply for the VA waiver? Is it automatic when you fill out the DD 2656 and select, "Yes I'm receiving VA PAY?"

My State (National Guard) retirement office will only speak to me after I retire. I will not have that opportunity until after 120 days after I retire. I need to figure this stuff out now so I can submit paperwork early.