Hello

@ArmyChiefTech

Background: I see many cases and they seem to blend together (for me), but from scanning thru the discussions within this thread, it appears you have a regular retirement

(not reserve/NG nonregular

nor CH 61 disability retirement).

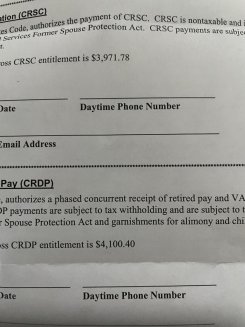

I infer your approved CRSC is at 100% and your VA comp is also at 100%.

CRDP with regular retirement: You would receive all your retired pay and all your VA compensation. The CRDP amount on page 2 of the RAS should be the amount of the VA offset.

CRDP is retired pay itself. The gross on your DFAS RAS under the CRDP scenario should be the CRDP amount plus the amount that would have been in excess of the VA offset IF the offset had been applied.

CRSC with regular retirement: Your retired pay will be reduced dollar for dollar in the amount of VA compensation received.

Any amount in excess of the reduction/waiver/offset is residual retired pay and that will paid on a DFAS RAS to you.

The 100% CRSC in your case based on the info provided should the same amount of the VA offset. It will be paid/shown on a CRSC statement. You also receive the VA ciomp.

Part of this explanation is based on my experience working with CRDP when the retired pay was actually reduced by the amount of VA comp. That ended several years ago.

Ron

cc:

@Provis

Edited to add: Once you make your decision, you will not be able to change it until open season, next January. I recommend you confirm whether the process described above will be what DFAS implements. You will probably have to ask for someone in the CRDP/CRSC section to get an accurate answer. Over the years, I have explained to DFAS how their computation of my CRDP or CRSC was incorrect. The last time, i had to resort to writing a letter to the Direcctor of DFAS-Cleveland, who is now retired. Although he used to "work for me" in a finance office in Germany (he was a SSG E6 at the time and I was a SGM E9), we are not buddies. He directed the repair because it was warranted.

I am not infallible, so confirmation by DFAS is advised.